The Rule of 72 & The Power of Compounding

When it comes to wealth management and financial planning in both the US and UK, understanding how your money grows, or loses value, over time is essential. One of the most effective tools to help investors visualise this is the Rule of 72.

What is the Rule of 72?

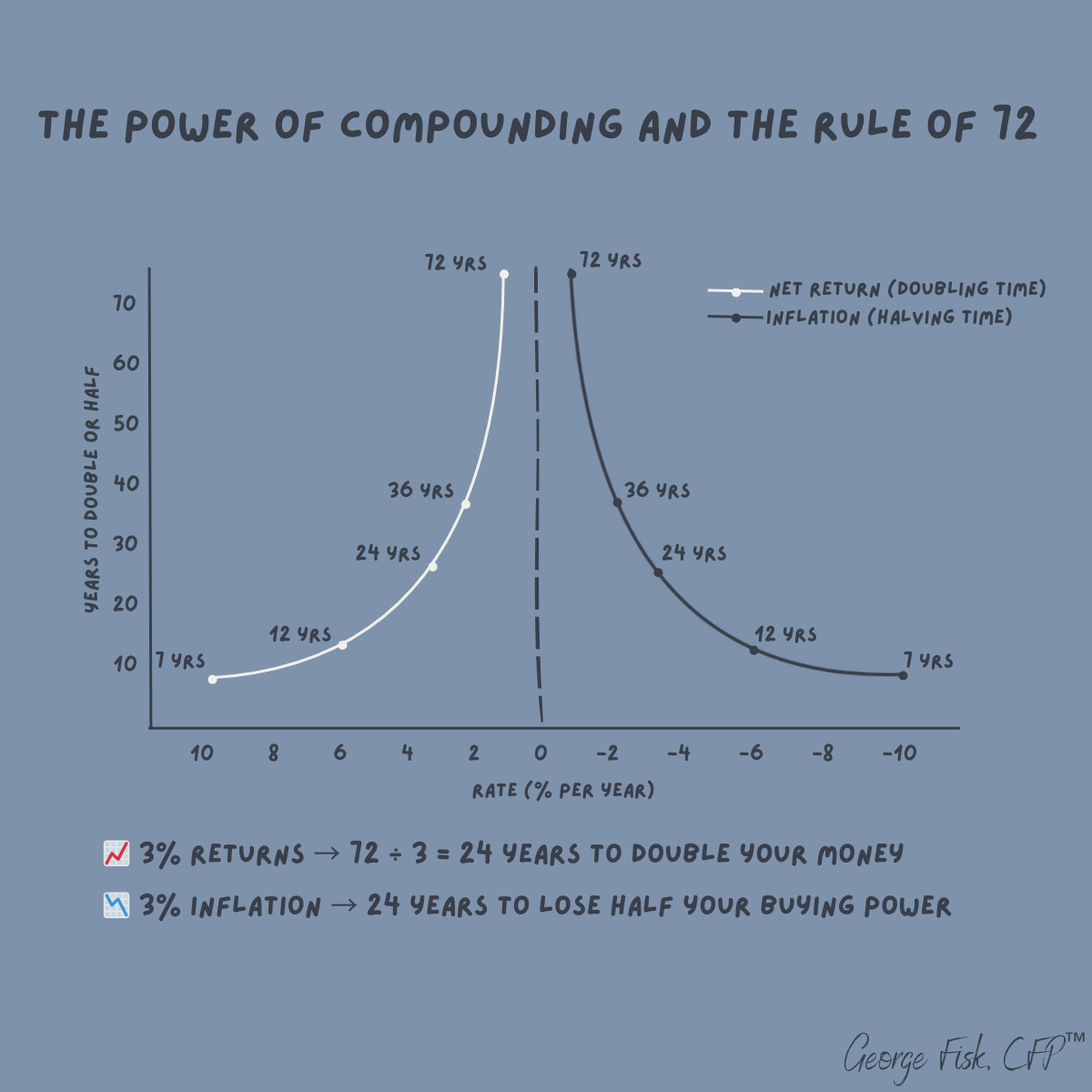

The Rule of 72 is a quick mental formula used by wealth managers and financial planners to estimate:

How long it will take for your investments to double in value

How quickly inflation will erode your purchasing power

The calculation is simple:

72 ÷ annual rate of return = years to double your money

72 ÷ inflation rate = years to lose half your buying power

Examples for US and UK Investors

📈 3% annual investment return → 72 ÷ 3 = 24 years to double your portfolio value

📉 3% annual inflation rate → 72 ÷ 3 = 24 years to lose half your purchasing power in real terms

Why It Matters for Financial Planning

For individuals in both the US and UK, the Rule of 72 makes abstract concepts like compounding and inflation tangible. It helps you see the long-term impact of your investment choices and the importance of a sound financial planning strategy.

This is not about chasing the latest market trends. Whether you are building a diversified investment portfolio in the US or planning retirement income in the UK, the key drivers of success remain the same:

Patience

Discipline

Time in the market

Building a Strategy That Works Across Borders

If you manage assets in multiple countries or are considering UK/US investments, it is even more important to account for different market conditions, interest rates, and inflation trends. The Rule of 72 provides a quick way to benchmark your expectations and ensure your wealth management plan is realistic.

Final Thought

Time is your greatest investment ally. By combining disciplined investing with a clear understanding of growth and inflation, you can make informed decisions that support your long-term wealth goals, whether in the US, UK, or both.